While this topic is very different from the usual content I write, I feel it will have value for those young adults with children that are sure to be following a similar track in life; “How do I pay for my child’s college education?” I’m not financially savvy by any means, but here’s your call to action if you haven’t yet done anything to start saving.

I’m a Gen Xer and I would consider myself as middle income. I’m not rich or poor by any means, but I don’t want for much either. I buy a car/SUV every 10 years or so, mow my own lawn, pay my monthly mortgage and yearly taxes. I hold a full-time job with a large retailer, I run my own consulting business and I try to volunteer regularly with a number of organizations. With three daughters I wasn’t exactly sure how I was going to save for their college education. After a lot of reading and research I decided that a Pennsylvania TAP 529 plan was the best tool and provided the most benefits for me and my family being a Pennsylvania resident. The biggest benefit is that all my TAP 529 contributions are tax deductible at the state level. In 2020 I believe the max contribution per beneficiary was $14,000. So I could contribute $14,000 to each of my TAP 529 plans and have those contributions deducted from my income on my state taxes. This will generally save me a few thousand dollars in taxes, which I can then re-invest back into the TAP 529 accounts. In addition, the funds I contribute to the TAP 529 are excluded from the FASFA application for student aid.

I ended up selecting the PA 529 Investment Plan, and that’s where the money has been gowning for the past few years. There’s a lot of flexibility in how the funds can be allocated, if you are interested in taking an active part you can select from a myriad of options. Or you can set it and forget it and the plan will automatically re-allocate the funds to less riskier investments the closer your child gets to college age.

My Thoughts

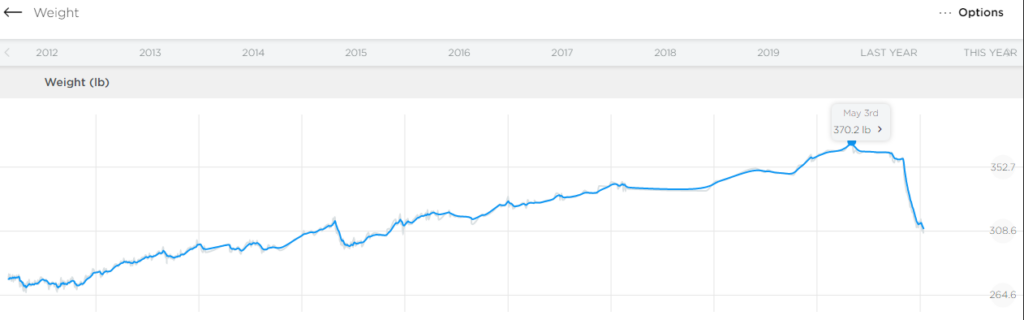

It’s never too late to start saving or investing. Whether you are saving for your child’s college education or for your eventual retirement, there are plenty of ways to start saving and investing today. In 2018 I opened an account with Betterment, a robo advisor. That account has provide a rate of return around 9.7% annually, not a phenomenal number by any stretch but it’s definitely better than 0%.

What are you doing today to save for your child’s college education or your retirement?

Cheers!